Tether's Precarious Perch

Reserve Opacity and the Looming Threat of Crypto Contagion

I. Introduction: Tether's Indispensable Fragility

A. The Ubiquitous Tether: Pillar of the Crypto-Economy

Tether (USDT), the largest stablecoin by market capitalization, has become an indispensable component of the global cryptocurrency ecosystem. With a market capitalization frequently exceeding $150 billion and commanding a dominant share of the stablecoin market, estimated between 62% and 70% , USDT's influence is pervasive. It functions as the primary trading pair for a vast array of cryptocurrencies on exchanges worldwide, underpinning market liquidity and facilitating price discovery. Beyond centralized exchanges, Tether is deeply interwoven into the fabric of decentralized finance (DeFi), where it serves as a critical source of liquidity for lending protocols, automated market makers, and as a widely accepted form of collateral. Its utility extends to bridging the gap between traditional fiat currencies and the digital asset space, enabling purportedly faster and cheaper cross-border payments and remittances, particularly in emerging markets where access to conventional banking may be constrained.

The sheer scale of Tether's operations and its profound integration across the crypto-economy elevate its stability to a matter of systemic importance. In many respects, USDT performs functions analogous to those of a central clearinghouse or a systemically important financial market utility in traditional finance. However, it operates with a degree of regulatory oversight and transparency that falls dramatically short of the standards applied to its conventional counterparts. This disparity between its systemic role and its operational opacity forms the crux of the risks it presents.

B. Thesis Statement: The Illusion of Stability and the Specter of Contagion

Despite its foundational role and persistent claims of robust 1:1 backing with the U.S. dollar, Tether's reserve composition remains shrouded in layers of opacity, its commitment to full and unambiguous transparency is questionable, and its operational history is marked by significant regulatory censure and periods of market stress. These elements coalesce to create a substantial and underappreciated potential for market-wide contagion. Should Tether face a crisis of confidence leading to a sustained de-pegging or, in a more severe scenario, insolvency, the ensuing shockwaves could dwarf previous cryptocurrency market crises, given USDT's magnified market share and deeper integration into the financial plumbing of the digital asset world.

The fundamental tension lies in Tether's systemic importance juxtaposed with its inherent systemic risk. The crypto market's profound reliance on USDT has fostered a dangerous complacency regarding the underlying vulnerabilities of its issuer. This dependence on an entity with a checkered past and an ongoing reluctance to embrace comprehensive transparency creates a precarious situation where the stability of the many is tethered to the questionable practices of the few. The market needs Tether for its daily operations, yet Tether itself is a significant, poorly understood, and inadequately regulated source of risk. This "indispensable fragility" arises directly from the crypto ecosystem's dependency on an entity whose risk profile remains a subject of intense and valid concern. If this fragile pillar were to crumble, its indispensability would only amplify the destructive reach of its failure.

II. The Anatomy of Tether's Reserves: A Critical Dissection

Tether's assertions of stability rest entirely on the quality and sufficiency of the assets backing its circulating supply of USDT. While recent disclosures point towards an improvement in the composition of these reserves, significant questions regarding transparency, liquidity, and risk concentration persist, particularly when scrutinizing the less transparent segments of its portfolio and the adequacy of its attestation regime.

A. Official Disclosures: The Q1 2025 Attestation by BDO

According to Tether's latest publicly available attestation report for the period ending March 31, 2025, conducted by BDO Italia, the company held total consolidated assets of approximately $149.28 billion against total consolidated liabilities of approximately $143.68 billion. This resulted in reported excess reserves of approximately $5.6 billion, a figure Tether presents as a buffer against potential losses.

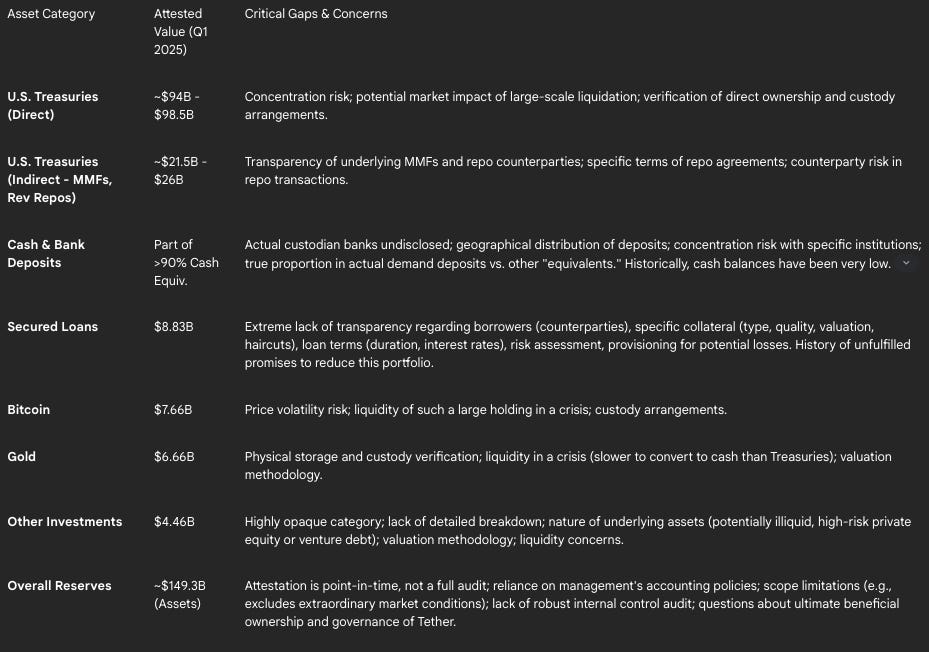

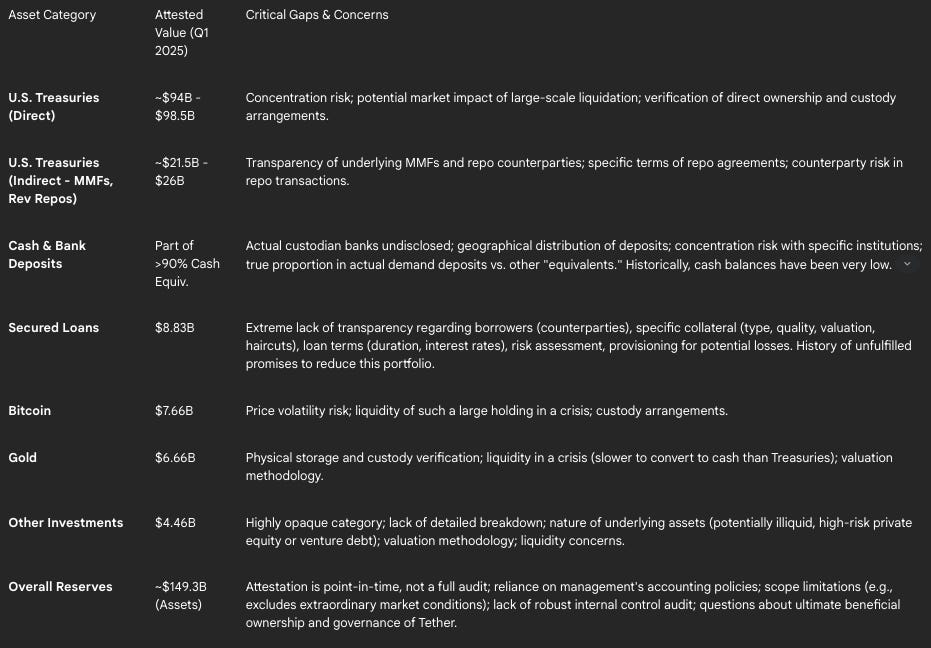

The breakdown of major reported asset classes within these reserves, as per the Q1 2025 attestation and related announcements, includes:

U.S. Treasuries: This is the largest component, with Tether's total exposure approaching $120 billion. This figure encompasses both direct holdings of U.S. Treasury bills and indirect exposure through investments in money market funds (MMFs) and reverse repurchase agreements collateralized by Treasuries. Direct holdings of U.S. Treasury bills were reported at over $94 billion, with some sources indicating as high as $98.5 billion, and these are stated to have an average maturity of under 90 days, enhancing their liquidity profile.

Cash and Cash Equivalents: Tether's attestations have consistently claimed that a significant majority (over 90% as of Q1 2025) of its reserves are held in cash and cash equivalents, a broad category that includes U.S. Treasuries, money market funds, and reverse repos.

Bitcoin: The Q1 2025 report indicated Bitcoin holdings valued at over $7.66 billion, based on a Bitcoin price of $82,704 at the time of the attestation.

Gold: Tether reported holding $6.66 billion in physical gold bars, stated to be of LBMA-standard.

Secured Loans: This category amounted to $8.83 billion in the Q1 2025 report.

Other Investments: A less transparent category, valued at $4.46 billion.

It is crucial to note that these attestations, including the one performed by BDO Italia, are not full financial audits. They provide a snapshot of the company's financial position at a specific point in time (e.g., March 31, 2025) and offer no assurance on the state of reserves or operational activities before or after that date. Furthermore, BDO's assurance report explicitly states that its opinion is based on the consolidated reserves report being "fairly presented, in all material respects, in accordance with the criteria set out in ‘Management’s Stated Accounting Policies’". This reliance on management-defined criteria, rather than universally accepted accounting principles applied through a comprehensive audit, limits the depth and independence of the assurance provided.

B. U.S. Treasuries: A Safe Haven or a Concentrated Vulnerability?

Tether's significant shift towards holding a substantial portion of its reserves in U.S. Treasury securities is, on its face, a positive development, suggesting a move towards higher-quality, more liquid assets compared to its historically more opaque and controversial holdings (such as unspecified commercial paper). The concentration in short-dated U.S. Treasury bills, with average maturities under 90 days for direct holdings, further supports the claim of maintaining a liquid reserve pool.

However, the sheer scale of Tether's U.S. Treasury holdings introduces new dimensions of risk and market impact. By Q1 2025, Tether directly held approximately $98.5 billion in U.S. Treasury bills, representing an estimated 1.6% of all outstanding Treasury bills. This positions Tether as one of the largest non-sovereign holders of short-term U.S. government debt, comparable to nation-state level investors. Research indicates that Tether's purchasing activity may already be influencing Treasury yields; one study found that a 1% increase in Tether's market share of T-bills is associated with a 1-month yield reduction of approximately 3.8%, translating to 14-16 basis points.

This significant presence in the Treasury market presents a double-edged sword. While U.S. Treasuries are considered among the safest and most liquid assets globally, Tether's concentrated ownership could become a source of systemic risk to the Treasury market itself. If Tether were to face a severe crisis of confidence—perhaps triggered by revelations of impairment in its other, less liquid or riskier reserve components, or a run on USDT—it would be compelled to liquidate its Treasury holdings rapidly and on a massive scale to meet redemption demands. Given its substantial market share, such large and sudden sales could overwhelm market absorption capacity, potentially depressing T-bill prices, increasing short-term yields, and disrupting the functioning of this critical funding market. This creates a scenario where instability in the cryptocurrency markets, via Tether, could spill over into traditional financial markets, a contagion pathway that is not yet widely appreciated or adequately modeled by regulators.

Furthermore, a paradox emerges when considering Tether's profitability against its transparency practices. The company reported operating profits exceeding $1 billion for Q1 2025, largely driven by returns from its U.S. Treasury portfolio. This substantial profitability would comfortably allow Tether to commission a comprehensive, full-scope financial audit from one of the "Big Four" global accounting firms—a step that would significantly enhance its credibility and address long-standing market concerns. Yet, despite claiming that such an audit is a "top priority", the company has consistently refrained from undertaking one, opting instead for limited-scope attestations. The financial capacity to fund a rigorous audit is clearly present. This persistent avoidance suggests that the reasons for not pursuing a full audit are likely not financial. This, in turn, fuels speculation about what a truly comprehensive audit might reveal concerning other, more opaque aspects of its reserves, its valuation methodologies for illiquid assets, or the full extent of its liabilities and off-balance sheet commitments.

C. The Opaque Corners: Secured Loans, "Other Investments," and Illiquid Holdings

While U.S. Treasuries form the largest and most transparent part of Tether's reported reserves, significant allocations to less clear and potentially riskier asset classes continue to be a major source of concern.

Secured Loans: As of Q1 2025, Tether reported $8.83 billion in secured loans. This figure represents a substantial exposure, and it has been growing; for instance, it was up from $6.57 billion reported for Q2 2024. Tether has emerged as a dominant force in the centralized crypto lending market, capturing an estimated 70-73% market share following the collapse of major crypto-native lenders like Celsius Network, BlockFi, and Genesis Global Capital.

The primary concerns regarding these secured loans revolve around a profound lack of transparency. Tether provides minimal public disclosure regarding the counterparties to these loans, the specific terms and conditions, the precise nature and quality of the collateral (beyond stating it is "widely overcollateralised in bitcoin"), and the risk management and provisioning policies applied to this loan book. The crypto lending sector is inherently high-risk, characterized by volatile collateral and often opaque borrowers, as evidenced by the string of bankruptcies in 2022. By stepping into this void, Tether is effectively taking on bank-like credit risks, but without the commensurate bank-like regulatory oversight, capital adequacy requirements, or transparency standards. Moreover, Tether has a history of making promises to reduce its secured loan portfolio to zero, only to see these balances subsequently increase, further eroding trust in its risk management pronouncements.

"Other Investments": The Q1 2025 attestation listed $4.46 billion under "Other Investments," a category that has historically been a black box. While Tether asserts that its strategic investments in areas like AI, energy, and P2P communications are made through "Tether Investments" and are not part of the reserves backing USDT , the lines can appear blurred, and the "Other Investments" category within the reserve report itself remains poorly detailed. Publicly available information and Tether's own announcements suggest these may include a diverse and potentially illiquid portfolio of equity stakes and debt in various private and public companies. Known or reported investments, some of which may fall under this reserve category or represent activities of the broader Tether group, include an early equity investment in the now-bankrupt Celsius Network (though Tether stated this was shareholder equity and not reserves, it is indicative of its investment risk appetite) , and investments in entities such as Exordium (web3 gaming), Bitrefill (crypto gift cards), NAKA (software development), Volcano Energy (Bitcoin mining in El Salvador), Northern Data Group (a publicly traded Bitcoin mining company, which also received a $610 million credit facility from Tether), Academy of Digital Industries, Oobit (crypto payments), CityPay.io (Georgian crypto payments), and a $200 million investment in Blackrock Neurotech, a U.S.-based brain-computer interface company.

Many of these investments are in highly volatile sectors, emerging markets, or early-stage companies, carrying significant liquidity and valuation risks. The methodologies used to value these private and often illiquid investments within the reserve attestations are not clearly disclosed, raising questions about their stated worth and recoverability under stress.

This engagement in venture-capital-style investments, even if nominally separated from USDT reserves via "Tether Investments," contributes to a commingling of risk appetite. The same overarching entity and leadership team are responsible for managing both the purportedly stable reserves backing USDT and these more speculative ventures. A significant financial loss or failure within Tether's investment arm could indirectly shake market confidence in the management's overall financial stewardship and prudence, potentially triggering fears about the integrity of USDT reserves, regardless of formal accounting separations. This represents a potent reputational and confidence-driven contagion risk. The success or failure of these ventures, which are far removed from the core business of managing a stablecoin, could impact the perceived stability of Tether as a whole.

D. The Persistent Audit Question: Why Attestations Fall Dramatically Short

For years, critics, regulators, and market participants have called on Tether to undergo a full, comprehensive financial audit conducted by a globally recognized, top-tier accounting firm (e.g., one of the U.S. or UK-based "Big Four"). Tether itself has acknowledged this demand, with its CEO Paolo Ardoino stating as recently as March 2025 that an audit is the company's "top priority". The company has been promising such an audit since at least 2017.

However, instead of a full audit, Tether has only provided periodic "attestations" or "assurance reports." These have been conducted by a series of accounting firms, including Friedman LLP in the early years (whose reports were later found to be misleading or lacking proper assurance ), Moore Cayman, and currently BDO Italia. While engaging BDO Italia, a member firm of a top-five global accounting network, represents an improvement over some previous arrangements, these attestations still fall dramatically short of the rigor and scope of a full financial audit.

The limitations of these attestations are significant:

Point-in-Time Snapshots: They reflect the company's asserted financial position on a single day, offering no assurance on the composition or sufficiency of reserves at any other time. The reserves could be manipulated to appear healthy on the attestation date.

Limited Scope: The assurance provided by BDO Italia explicitly notes that the valuation of assets is based on "normal trading conditions" and does not reflect outcomes under "unexpected and extraordinary market conditions" or in the event of "key custodians or counterparties experiencing substantial illiquidity". These are precisely the conditions under which a stablecoin's backing would be most severely tested.

Not a Comprehensive Examination: Attestations do not typically involve a deep dive into the company's internal controls over financial reporting, a thorough verification of the existence and ownership of all assets, an independent assessment of valuation methodologies for all asset classes (especially complex or illiquid ones like secured loans and private equity), or a full review of all liabilities and contingent obligations.

Historical Precedent: The 2017 "Transparency Update" involving Friedman LLP, which was later highlighted in the NYAG settlement, showed how such limited engagements could be misleading. Bitfinex reportedly transferred funds to Tether's account on the morning of Friedman's verification, creating a temporary illusion of full backing.

For an entity of Tether's systemic importance in the multi-trillion dollar cryptocurrency market, the persistent absence of a full audit by a major, independent accounting firm headquartered in a jurisdiction with robust audit standards (like the U.S. or UK) is a glaring deficiency and a significant red flag. It undermines trust and leaves critical questions about the true nature and stability of its reserves unanswered.

The continued deferral of a full audit, despite Tether's substantial profitability (which could easily cover the costs) and its public pronouncements about it being a "top priority," suggests that the obstacles may be strategic rather than purely logistical or financial. It is plausible that Tether is avoiding the deeper level of scrutiny that a full audit would entail, perhaps to shield certain aspects of its asset portfolio, liability structure, operational practices, or relationships with affiliated entities from rigorous independent verification. This "audit obstacle" appears to be a deliberate choice, one that perpetuates uncertainty and risk.

The following table summarizes the official claims regarding Tether's Q1 2025 reserve composition alongside the critical gaps and concerns that remain unaddressed by the current attestation regime:

Table 1: Tether's Q1 2025 Reserve Composition: Official Claims vs. Critical Gaps

III. A Legacy of Doubt: Regulatory Battles and Transparency Failures

Tether's current attestations and public statements cannot be viewed in a vacuum. They exist against a backdrop of significant regulatory settlements and a persistent pattern of behavior that has sown deep-seated doubts about the company's commitment to transparency and truthful representation. This history is crucial for understanding the ongoing risks associated with USDT.

A. Historical Misrepresentations: Lessons from NYAG and CFTC Settlements

Two landmark settlements with U.S. regulatory bodies paint a damning picture of Tether's past practices regarding its reserve backing.

New York Attorney General (NYAG) Settlement (February 2021): Tether and its affiliated exchange, Bitfinex, agreed to pay an $18.5 million penalty to settle charges brought by the NYAG. While the companies admitted no wrongdoing, the NYAG's findings were unequivocal. Attorney General Letitia James stated bluntly: "Tether's claims that its virtual currency was fully backed by U.S. dollars at all times was a lie".

The investigation revealed that for extended periods, USDT was not fully backed 1:1 by U.S. dollars held in reserve. It uncovered instances of Tether's funds being commingled with Bitfinex's corporate and client funds, and highlighted how Tether had access to only limited banking for significant periods, relying on unconventional arrangements. Critically, the NYAG found that Tether had issued misleading "Transparency Updates." For example, after publicizing a letter from Deltec Bank in November 2018 claiming its accounts held sufficient funds to back circulating USDT, Tether transferred almost $500 million from its bank account to Bitfinex's account the very next day, meaning USDT was no longer fully backed one-to-one shortly after the public assurance. The settlement also detailed how Bitfinex borrowed hundreds of millions from Tether's reserves to cover an $850 million shortfall after funds were lost or frozen at a payment processor, Crypto Capital.

Commodity Futures Trading Commission (CFTC) Settlement (October 2021): The CFTC ordered Tether to pay a $41 million civil monetary penalty for making "untrue or misleading statements and omissions of material fact in connection with the U.S. dollar tether token (USDT) stablecoin". The CFTC found that from at least June 1, 2016, to February 25, 2019, Tether misrepresented that every outstanding USDT was backed by U.S. dollars held by Tether and safely secured in bank accounts. In reality, the CFTC determined that Tether only held sufficient fiat reserves to back the USDT in circulation for a mere 27.6% of the days within a 26-month sample period examined.

Furthermore, the CFTC found that Tether failed to disclose that its reserves included unsecured receivables and non-fiat assets. The company also falsely represented to users and the market that it would undergo routine, professional audits to demonstrate that it maintained 100% reserves, when, in fact, such audits were never performed.

These settlements are not minor infractions. They establish a documented history of material misrepresentations by Tether regarding the most fundamental promise of a stablecoin: its consistent and verifiable backing. This legacy of doubt inevitably colors any assessment of Tether's current claims and its much-touted, yet still limited, attestations.

B. The El Salvador Gambit: Regulatory Arbitrage or Genuine Oversight?

In a move highlighted in its Q1 2025 announcements, Tether revealed it had obtained a license as a digital asset service provider (specifically for issuing stablecoins) under El Salvador's Digital Assets regulatory framework. Consequently, its Q1 2025 attestation by BDO Italia was presented as its first under this new regulatory supervision. Tether portrays this as a step towards enhanced credibility and compliant growth.

However, this development warrants critical scrutiny. El Salvador's embrace of cryptocurrencies, including making Bitcoin legal tender, is highly experimental and its regulatory framework for digital assets is nascent and largely untested on a global scale, especially concerning an entity with the systemic footprint of Tether. Major financial centers like New York, London, or those within the European Union have far more established, typically more stringent, and demonstrably more robust regulatory and supervisory regimes for financial institutions and systemically important payment systems.

Given Tether's history of friction with regulators in more established jurisdictions like the U.S. (evidenced by the NYAG and CFTC settlements ), the decision to seek licensure in El Salvador could be interpreted as a form of regulatory arbitrage. This is a strategy where a company seeks out jurisdictions with more lenient, less developed, or "innovation-friendly" (which can often mean less intrusive) regulations to minimize compliance burdens and scrutiny. The "El Salvador gambit" may therefore represent a "regulatory façade" concern: an attempt to project an image of regulatory legitimacy without subjecting Tether to the rigorous, in-depth, and continuous oversight that would likely be imposed by regulators in major international financial hubs. The actual capacity and commitment of the El Salvadoran authorities to effectively supervise a global behemoth like Tether, and to enforce compliance robustly, remain significant open questions. This move does little to assuage concerns about Tether's commitment to operating under genuinely demanding regulatory standards.

C. Ongoing Governance and Transparency Deficits

Beyond the historical settlements and the nature of its current regulatory arrangements, Tether continues to exhibit significant deficits in corporate governance and operational transparency. Questions persist regarding its complex and opaque corporate structure, the identities of its ultimate beneficial owners, and its internal governance practices. Tether Holdings Limited is incorporated in the British Virgin Islands, a jurisdiction known for corporate secrecy, with operational offices reportedly in Switzerland, though specific details are often scant.

The "transparency reports" and attestations that Tether publishes, while an improvement from its earlier complete silence, still lack the depth, detail, and independent verification that a full audit of the entire Tether group's financials would provide. There has also been a notable shift in the frequency of these reports. While Tether had indicated it would publish monthly financial reports from the start of 2023, its current reserve attestations, such as the Q1 2025 report, are provided on a quarterly basis. This reduction in frequency further limits timely insight into its reserve status.

Adding to these concerns are allegations, highlighted in a lawsuit referenced by a consumer watchdog group, suggesting that Tether, in conjunction with Alameda Research (the trading firm founded by Sam Bankman-Fried), engaged in practices to artificially inflate market demand for USDT. The suit alleged that Alameda would receive newly minted USDT, at times in a manner that could inflate USDT's market price, and then sell this USDT in the market, allowing Tether to receive U.S. dollars for USDT "minted from nothing". While these are allegations in a lawsuit, they draw uncomfortable parallels to the opaque and manipulative practices that led to the collapse of FTX and Alameda, further underscoring the risks associated with Tether's lack of comprehensive transparency.

True transparency for an entity of Tether's scale and systemic importance must extend far beyond periodic, limited-scope attestations of its token reserves. It requires clear and verifiable information on its corporate governance, audited financial statements for the entire holding structure (not just the token-issuing entities), robust internal controls, and clear accountability mechanisms for its leadership. Tether consistently fails to meet these broader transparency expectations.

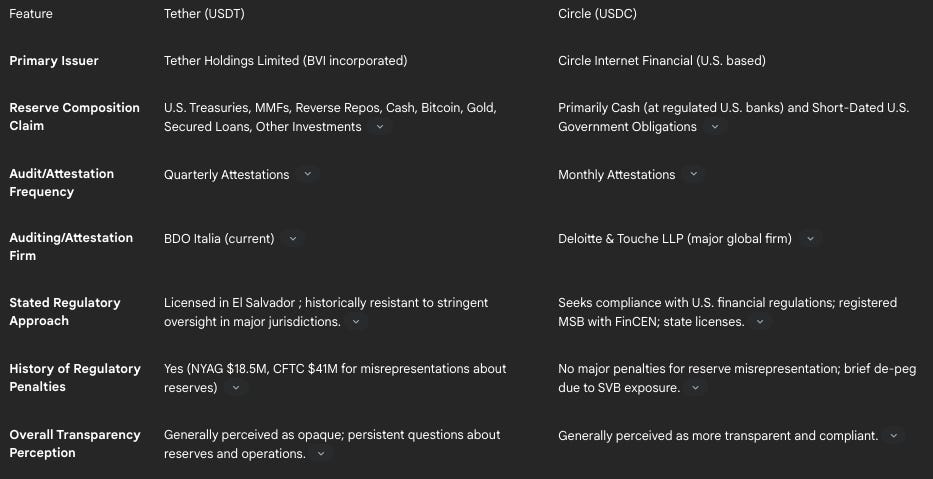

D. Comparison with Competitors: The USDC Case

The argument that Tether's level of opacity is simply an unavoidable characteristic of the stablecoin industry is effectively countered by examining the practices of its chief competitor, USD Coin (USDC). USDC, primarily issued by Circle Internet Financial, is the second-largest stablecoin and is often cited for its comparatively greater transparency and commitment to regulatory compliance.

USDC provides monthly attestations of its reserves, which are conducted by reputable global accounting firms such as Deloitte & Touche LLP. These reports detail reserves composed primarily of cash held in U.S. regulated financial institutions and short-dated U.S. government obligations. Circle actively seeks to comply with U.S. financial regulations, is registered as a Money Services Business with FinCEN, and has pursued state money transmitter licenses in the U.S.. While no system is without risk, and USDC itself faced a brief de-pegging scare in March 2023 due to exposure to Silicon Valley Bank , its operational model generally demonstrates that a higher degree of transparency and regulatory alignment is indeed achievable for a large, dollar-pegged stablecoin.

This comparison is critical. If Circle can operate USDC with more frequent and arguably more credible reserve verifications, and with a more proactive stance towards regulatory engagement in major financial jurisdictions, it makes Tether's persistent opacity and its regulatory choices appear less like an industry norm and more like deliberate strategic decisions. The "viability of transparency" demonstrated by USDC suggests that Tether could be significantly more transparent and compliant if it chose to be. Its failure to do so, therefore, raises more profound questions about its motives and what it might be seeking to conceal.

The following table provides a timeline of some of Tether's key controversies and regulatory actions, illustrating the recurring nature of these issues:

Table 2: Timeline of Tether's Key Controversies and Regulatory Actions

IV. The Contagion Calculus: Tether's Potential to Unleash Systemic Shock

Given Tether's immense market capitalization, its deep integration into the cryptocurrency trading and DeFi ecosystems, and the persistent doubts surrounding its reserves and operational integrity, a failure or significant de-pegging of USDT carries the potential for catastrophic contagion across the entire digital asset landscape and, increasingly, into segments of traditional finance.

A. Mechanisms of Systemic Risk: How Tether's Failure Could Cascade

A crisis of confidence in Tether could propagate through several interconnected mechanisms, leading to a systemic shock:

Liquidity Shocks and Fire Sales: A "run" on USDT, where a large volume of holders simultaneously attempt to redeem their tokens for fiat currency or swap them for other assets, would place immense pressure on Tether's reserves. If Tether cannot meet these redemption demands from its most liquid assets (cash and easily sellable Treasuries), it would be forced to liquidate its less liquid holdings—such as Bitcoin, gold, its portfolio of secured loans (which may be difficult to call or sell quickly without significant discounts), or its "other investments"—at fire-sale prices. Such distressed sales would not only realize losses for Tether but also depress the market prices of the assets being sold, further exacerbating the crisis.

Impact on Exchanges: Cryptocurrency exchanges globally hold vast quantities of USDT, as it is a primary trading pair for countless digital assets. A significant and sustained de-pegging of USDT, or doubts about its redeemability, would cripple exchange liquidity. Trading in USDT pairs would likely be halted, and exchanges could face runs from users trying to withdraw assets. If exchanges have significant USDT holdings as part of their operational capital or customer balances that become impaired, it could lead to widespread exchange insolvencies.

DeFi Protocol Collapse: USDT is a cornerstone of the DeFi ecosystem, widely used as collateral in lending protocols, a primary component of liquidity pools in decentralized exchanges (DEXs), and a means of yield generation. If USDT loses its peg or its value becomes uncertain, it would trigger mass liquidations of loans collateralized by USDT. Liquidity pools heavily reliant on USDT would become imbalanced and potentially drained, leading to protocol failures and a widespread freeze in DeFi activity. The interconnected nature of DeFi protocols means that the failure of USDT-based systems could cascade rapidly, causing a domino effect of insolvencies and value destruction.

Market Sentiment Collapse: Tether is often seen as a bellwether for the stability of the broader crypto market. Its failure would not just be a financial event but a profound psychological blow, shattering the already fragile confidence of many investors and institutions in the digital asset space. This could trigger a "crypto winter" far more severe and prolonged than previous downturns, given USDT's significantly larger market share and deeper integration compared to past periods of market stress.

Parallels to FTX: Consumer watchdogs and analysts have explicitly drawn parallels between the risks posed by Tether's opacity and the catastrophic collapse of the FTX exchange and its sister trading firm Alameda Research. The concern is that a lack of transparency could be masking financial mismanagement, undisclosed liabilities, or improper use of assets on a scale that could lead to a sudden and devastating implosion, similar to what occurred with FTX.

B. De-Pegging Nightmares: Past Incidents as Harbingers

While Tether has, to date, managed to recover its peg after periods of instability, past de-pegging incidents serve as stark reminders that its link to the U.S. dollar is not infallible and can be stressed by market dynamics, rumors, or structural vulnerabilities.

October 2018 De-Peg: In October 2018, the price of USDT briefly fell to as low as $0.88 on some exchanges. This de-pegging occurred amidst a flurry of rumors concerning the solvency of Bitfinex (its affiliated exchange), issues with banking relationships, and broader concerns about the sufficiency and quality of Tether's reserves. The event highlighted the market's acute sensitivity to perceived counterparty risk and the potential for rapid loss of confidence.

June 2023 De-Peg: More recently, in June 2023, USDT experienced a minor but notable de-pegging, with its price dipping to around $0.977. This deviation was attributed to a significant imbalance in Curve's 3pool, a major DeFi liquidity pool for stablecoins (USDT, USDC, DAI). Tether's proportion in the pool surged to over 70%, far exceeding its intended one-third share, indicating large-scale selling or swapping of USDT for other stablecoins within that pool. Crypto research firm Kaiko noted at the time that this appeared to be "a possible attempt to depeg Tether" or at least a significant stress test of its liquidity in DeFi.

These incidents, though ultimately resolved, demonstrate that USDT's peg can and does come under pressure. A critical factor to consider is Tether's minimum redemption threshold, which is reportedly $100,000. This means that the vast majority of USDT holders cannot redeem their tokens directly from Tether for U.S. dollars. Instead, they are reliant on secondary market liquidity on exchanges or in DeFi pools. In a crisis, this secondary market liquidity can evaporate quickly, leaving smaller holders stranded with de-pegged tokens while larger, eligible entities might be able to redeem directly (if Tether honors such redemptions). This creates a tiered system of risk and access that could exacerbate panic selling among retail and smaller institutional holders.

C. The Shadow over Traditional Finance: Tether's Footprint in U.S. Treasuries

Historically, concerns about Tether's potential impact were largely confined to the crypto-native ecosystem. However, Tether's strategy of amassing a vast portfolio of U.S. Treasury securities has created a new and potentially significant vector for contagion into traditional financial markets. As one of the largest holders of short-term U.S. Treasury bills, with holdings representing approximately 1.6% of the total outstanding T-bills , Tether's actions can no longer be ignored by traditional market participants and regulators.

A forced, rapid liquidation of Tether's substantial T-bill portfolio—necessitated by a run on USDT—could exert downward pressure on T-bill prices and upward pressure on short-term yields, potentially disrupting the smooth functioning of this critical market segment. Moody's Ratings has warned that a "sudden loss of confidence, regulatory pressure, or market rumors, this could trigger large-scale liquidations, potentially depressing Treasury prices and disrupting fixed-income markets". Analysts at JP Morgan have estimated that stablecoin issuers, with Tether being the largest by far, could collectively become the third-largest buyer of Treasury bills in the coming years, further underscoring their growing systemic relevance.

The Treasury Borrowing Advisory Committee (TBAC), a group that advises the U.S. government on its funding strategy, has also noted that the growth of the stablecoin market at the expense of traditional bank deposits could reduce banks' demand for U.S. Treasuries and potentially impact credit growth. Concerns are also being voiced by international regulators; the Bank of Italy, for instance, has warned that disruptions in the stablecoin market or the underlying bond markets they invest in could have "repercussions for other parts of the global financial system".

These developments illustrate the unintended consequences of crypto's increasing embrace of traditional financial assets. While Tether's move into U.S. Treasuries was ostensibly to bolster the perceived safety and liquidity of its reserves, the sheer scale of these holdings now means that a crisis originating within Tether and the crypto markets could transmit stress into the core of the U.S. government debt market. This blurring of lines between crypto risk and traditional financial stability is a relatively new phenomenon and one that regulators are only beginning to grapple with. The stability of a key segment of the U.S. financial system is now, to some extent, linked to the fortunes of an opaque and largely unregulated offshore entity.

V. Critical Assessment: Navigating the Tether Tightrope

Evaluating the true risk profile of Tether requires a synthesis of its official disclosures, its historical conduct, the nature of its assets, and the adequacy of its transparency and regulatory arrangements. The picture that emerges is one of an entity that, while making some strides in improving the quality of its reported reserves, continues to operate with a level of opacity and a risk appetite that are incongruous with its systemic importance.

A. Evaluating the True Risk Profile of Tether's Reserves

While Tether's Q1 2025 attestation indicates that U.S. Treasuries and cash equivalents constitute the bulk of its reserves, significant concerns remain about the overall risk profile:

Asset Quality Mix: Beyond the ostensibly safe U.S. Treasuries, Tether holds substantial amounts in more volatile or less liquid assets. Its $7.66 billion in Bitcoin is subject to extreme price volatility. The $6.66 billion in gold, while a traditional store of value, is less liquid than cash or Treasuries in a rapid redemption scenario.

Opaque and Illiquid Holdings: The $8.83 billion in secured loans remains a major concern due to the lack of transparency regarding counterparties, collateral quality (beyond general claims of Bitcoin over-collateralization), and loan terms. The $4.46 billion in "Other Investments" is similarly opaque and likely includes illiquid, venture-capital-style investments with uncertain valuations and recovery prospects.

Adequacy of Excess Reserves: The reported $5.6 billion in "excess reserves" over liabilities provides a cushion. However, this buffer could be rapidly eroded by a sharp decline in the market value of its Bitcoin holdings, a default wave within its secured loan portfolio (requiring significant provisions), or write-downs in its "other investments." Notably, this excess reserve figure has decreased from $7.1 billion reported for Q4 2024, indicating a potential reduction in this buffer. The true mark-to-market value and liquidity of all reserve components, especially under stressed market conditions, remain uncertain without a full audit.

B. The Inadequacy of Current Disclosures and Regulatory Frameworks

The core issue remains the profound inadequacy of Tether's disclosure regime. Quarterly attestations, limited in scope and reliant on management-defined accounting policies, are not a substitute for a full, independent financial audit conducted by a globally recognized firm under stringent auditing standards. The absence of such an audit remains the central point of failure in Tether's transparency efforts and the primary reason for persistent market skepticism.

Furthermore, Tether's recent move to obtain regulatory licensing in El Salvador is unlikely to provide the robust, credible oversight required for an entity of its global scale and systemic impact. As discussed, this appears more akin to regulatory arbitrage than a genuine commitment to operating under a rigorous and internationally respected regulatory framework (see Section III.B). Global regulatory coordination on systemically important stablecoins like Tether is still in its nascent stages, leaving significant gaps in oversight and enforcement.

C. The Urgent Need for Systemic Safeguards

The cryptocurrency market's extensive reliance on a single, opaquely managed, and historically controversial stablecoin issuer constitutes a significant systemic vulnerability. This dependency has fostered an environment where the risks associated with Tether are, to some extent, socialized across the entire ecosystem.

This situation may also be creating a form of moral hazard, akin to the "too big to fail" phenomenon observed in traditional financial markets. Because Tether is so deeply embedded in the crypto-economy , and its collapse would likely have devastating consequences for countless users, exchanges, and DeFi protocols , market participants might continue to use and rely on USDT despite the known risks. They may implicitly assume that Tether's sheer size makes it impervious to failure, or that, in a worst-case scenario, some form of intervention (perhaps by major exchanges or other large players) would occur to prevent a total market meltdown. This perception, whether accurate or not, can reduce the collective market pressure that might otherwise compel Tether to implement genuine and far-reaching reforms regarding its transparency, reserve management, and corporate governance. If the perceived cost of switching away from USDT is too high for many individual actors, the incentive for Tether to change its practices is diminished.

To provide further context on the differing approaches to transparency and regulatory adherence within the stablecoin market, the following table offers a comparative glance between Tether (USDT) and its main competitor, USD Coin (USDC):

Table 3: USDT vs. USDC: A Comparative Glance at Transparency and Regulatory Adherence

This comparison underscores that a higher standard of transparency and regulatory engagement is not only possible but is actively being pursued by other major players in the stablecoin market. Tether's divergence from these practices is therefore a matter of choice, not necessity.

VI. Conclusion: A Call for Unwavering Scrutiny and Proactive Mitigation

The analysis of Tether's reserve composition, its operational transparency, its regulatory history, and its systemic importance leads to an unavoidable and deeply concerning conclusion: Tether (USDT) represents one of the most significant and concentrated sources of systemic risk within the global cryptocurrency ecosystem. Its stability is a linchpin for a vast network of trading activity, DeFi protocols, and financial flows, yet this stability is predicated on a foundation that exhibits persistent opacity, questionable asset valuations, and a troubling reluctance to embrace globally accepted standards of financial accountability.

A. Reiteration of Tether's Profound and Concentrated Risks

The key vulnerabilities are manifold and interconnected:

Opaque Reserve Components: While a substantial portion of reserves is reportedly held in U.S. Treasuries, significant allocations to volatile assets like Bitcoin, less liquid assets like gold, and highly opaque categories such as secured loans and "other investments" introduce considerable uncertainty and risk. The true quality, liquidity, and valuation of these components remain inadequately verified.

Lack of a Full Audit: The continued absence of a comprehensive financial audit by a reputable, independent, and globally recognized accounting firm is the single most critical failure in Tether's transparency regime. Attestations, particularly those with limited scope and reliance on management-defined policies, are insufficient for an entity of this scale and systemic relevance.

Concerning Regulatory History and Posture: Past settlements with the NYAG and CFTC for material misrepresentations about reserve backing have established a legacy of doubt. The current regulatory arrangement under El Salvador's nascent framework does little to inspire confidence in robust oversight.

Immense Potential for Contagion: A crisis of confidence in Tether, leading to a sustained de-pegging or failure, would likely trigger cascading failures across cryptocurrency exchanges, DeFi protocols, and the broader digital asset market. The potential for spillover into traditional financial markets, particularly the U.S. Treasury market, is a growing and alarming concern.

B. The Imperative for Action: Demanding Accountability

The risks posed by Tether are too significant to be ignored or wished away. Proactive mitigation and a concerted demand for accountability are urgently required from all stakeholders:

Investors and Market Participants: Users of USDT, from individual traders to large institutions, must critically assess the risks they are undertaking by holding and transacting in Tether. Demands for greater transparency, verifiable reserve quality, and robust risk management should be unequivocal. Diversification away from an over-reliance on USDT should be a strategic consideration.

Regulators Globally: Financial regulators in major jurisdictions must accelerate efforts to establish and enforce stringent, harmonized standards for systemically important stablecoins. These standards must include, at a minimum:

Mandatory, full-scope annual financial audits conducted by independent, reputable accounting firms according to internationally accepted auditing standards.

Detailed, frequent, and verifiable public disclosures of reserve composition, including specific asset breakdowns, custodian information, valuation methodologies, and liquidity profiles.

Strict requirements for the quality, liquidity, and diversification of reserve assets.

Robust governance, risk management, and internal control frameworks.

Clear prudential requirements, potentially including capital buffers.

The Cryptocurrency Industry: The broader crypto industry has a profound vested interest in mitigating the systemic risks posed by Tether. The credibility and long-term viability of the digital asset ecosystem are undermined by the continued presence of a systemically critical entity that operates with such a significant transparency deficit. Industry bodies and influential players should advocate for higher standards and support initiatives that promote genuine stability and accountability.

In essence, the stability of a multi-trillion dollar digital asset market is, to a disconcerting degree, "tethered" to an entity that has repeatedly demonstrated a reluctance to embrace the fundamental principles of financial transparency and accountability that are standard in traditional, regulated financial markets. This is an untenable long-term situation. Without unwavering scrutiny and proactive measures to enforce higher standards, the cryptocurrency market remains perilously exposed to a contagion event originating from its most systemically important, yet arguably most enigmatic, cornerstone.